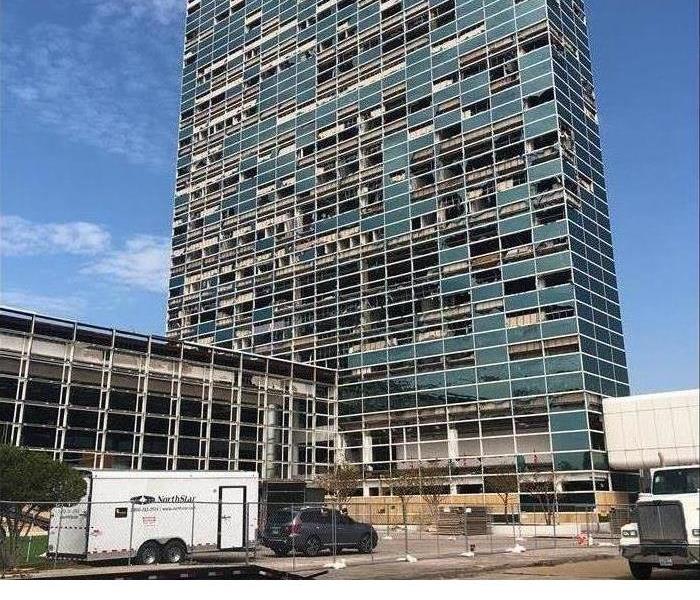

Commercial Insurance for Flood-Related Damage

8/17/2022 (Permalink)

What To Look For In Terms Of Flood Insurance

Any attempt to make an insurance claim for flooding on a standard commercial insurance policy will quickly reveal the need for a separate flood policy. Find out why general property insurance often excludes flood damage and what to look for in terms of flood insurance for a commercial building in Burlingame, Millbrae.

Most General Policies Exclude Flooding

Primary commercial property insurance policies often exclude incidents in which external water breaches the interior of a structure, with the exception of leaks in an otherwise well-maintained roof. Check to see whether the following types of damage are cut out of a general policy:

- Flooding

- Sewer backups

- Storm surges

It is necessary to obtain endorsements or supplemental policies to cover this damage. Flood policies typically cover storm surges, but an additional rider or policy is required for cleaning and restoring sewer damage. The National Flood Insurance Program

The NFIP is a relatively easy way for commercial property owners to get coverage for flooding. Property must be located in a community that participates in the program. If the owner of a property located in an area with a high flood risk has a mortgage from a federally-backed lender, flood coverage may be a requirement. This policy may include up to $500,000 in coverage for a structure and up to $500,000 for business or personal content.

Private Commercial Insurance

If the NFIP is not available in a particular area, a property owner may want to obtain an independent flood policy through a private insurer. Check to see whether a primary commercial insurer also offers flood coverage.

If you own a commercial building in Burlingame, Millbrae you should be aware of the extent of your insurance coverage. General property insurance, flood insurance, and additional policies or riders to cover interruptions can keep a business afloat in the event of major flooding or other storm damage.

24/7 Emergency Service

24/7 Emergency Service